How to register a business in the Philippines as a Foreigner

Registering a business in the Philippines as a Foreigner involves navigating many regulatory and agency requirements. Obeying legal requirements to the letter will help you avoid future problems and consulting a legal expert is often advisable to ensure compliance.

Step 1: Choose ownership structure. Their are (6) six different structure.

- Sole Proprietorship– is a type of business owned and operated by one person, no partners, no board of directors and no share holders to weigh in on. Only one person makes all the decisions.

- General Partnerships– this is under the (SEC) Securities and Exchange commission. A general partnership is an agreement between (2) two or more individuals who agree to share in the profits, losses and legal liabilities of a company. In a general partnership, each partner is responsible for filling their own taxes based on the income passed to them through the partnership. There is no limit to their personal liability, meaning that partners have unlimited responsibility for the company’s debts and lrgl liabilities. However, it is generally advisable to have a written partnership agreement.

- Limited Liability Company (LLC)– is a business structure that limits the personal liability of LLC Members. An LLC becomes an official business entity when it is registered with the Secretary of State in the state where the business resides and operating. By limiting the personal liability of the members, the LLC ensures that only company’s assets can be used to pay debts and meet other liabilities. The owners of an LLC are called members such as limited partners or shareholder, are not liable fot the company’s debts based on their status as owner.

- Limited Liability Partnerships (LLP)– is a partnership structure registered as a business entity that reduces the liability of each partner to what they have contributed. The risk of the business is spread among the partners who each havve defined roles in the company. Because liability is limited, creditors cannot go after the partners’ personal assets for the company’s debts and liabilities. the partners in an LLP are protected from liability for any of the debts and obligations of the partnership. In some states, however, partners are not liable for debts arising from the negligence or wrongful acts of other partners, but remain liable for other debts and liabilities.

- C-Corporation– is a business entity set-up with shareholders as owners of the company. The shareholdder’s liability is the company’s liabilities, meaning their personal assets are not a risk. Unlike an LLC, where profits go directly to the members, the C-corporation is taxed as its own entity. A C-corporation is governed by a board od directors and must file an annual report with the state.

- S- Corporation– is simliar to a C-corporation in that it registers with the state as an enity, issues share to owners and has a board of directors. The difference between C-corporation and S-corporation is that an S-corporation chooses to pass the profits through to the owners. This elliminates the possibility of double taxation as a corporation.

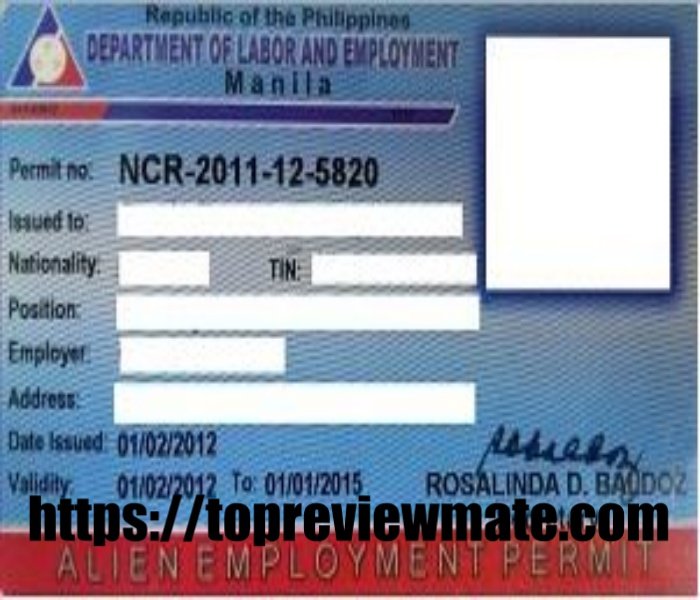

Step 2: Secure an Alien Employment Permit (AEP)– Foreigners are required to obtain an Alien Employment Permit from the Department of Labor and Employment (DOLE) before they can work, including managing a business.

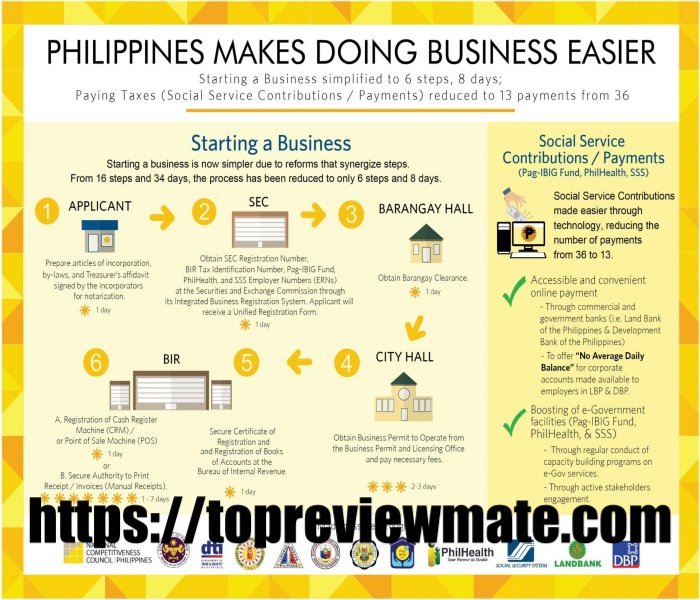

Step 3: Register with the securities and exchange commision (SEC)- You need to register your chosen business structure with the SEC in charge of company registrants. Prepare the necessary documents such as Articles of Incorporation and By-laws and submit them with the SEC.

Step 4: Get Taxpayer ID Number- Once you registered with the SEC, Apply for a Tax Identification Number (TIN) from the Bureau of Internal Revenue (BIR). Use this number in all transactions and reporting related to tax.

Step 5: Mayor’s Permit and Business License- Rigistered the business with the Local Government Unit (LGU) where it will operate. This includes obtaining the Mayor’s Permit and paying the required local taxes.

How to get Mayor permit and Business permit

- Secure Business Name in Registration in DTI/SEC- They need to know that your business name is anonymous.

- Obtain Cedula and Barangay Business Permit.

- Apply for a business permit at the Business Licensing Office of your City Hall

- Accomplish Business Permit Application Form

- Apply for health/Sanitary Permit

- Apply for Fire Safety Permit

- Apply for other permits or submit other requirements they are requiring depending on the nature of the business

- Payment of fees.

- BIR Registation

- SSS, PAg-IBIG, Philhealth , Business Registration

Step 6: Open Local bank account- If you open a local account it is necessary that you have an SEC certificate of Registration.

Step 7: Secure additional Permits- Depending on the type of your business,. You can add an expert for Fire Safety Inspection Certificate, Environmental Clearance Certificate or other industry specific ones.

Step 8: Comply with Visa Requirements- Foreign nationals who wish to work in the Philippines may also required to obtain an appropriate working visa from the Bureau of Immigration.

Step 9: Reporting and compliance- Foreign-owned businesses must comply periodic reporting requirement such as General Sheet (GSIS) in the SEC, Monthly and annual tax filling the BIR and other more submissions to various government agencies.

These are the things that foreigners need to set up a business. I hope my content has helped you, thank you.